Oil Markets in 2022: Key trends to look out for

And just like that, we wave goodbye to 2021. Welcome to 2022, its the year of the Tiger, it’s finally time for the oil markets to roar.

Here are some thoughts on what we think could happen in 2022.

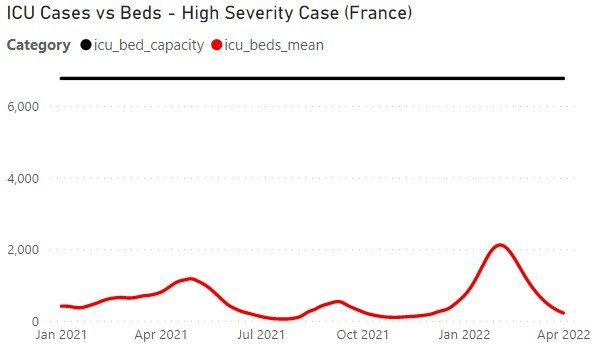

1. COVID: Unfortunately, COVID is here to stay and will move oil markets in 2022. New variants are inevitable but will have a declining impact on oil demand. The latest IHME forecast has higher cases but no major stress on hospitals. Scenarios in November from the same source were expecting hospitals to overload in Europe due to Delta. Omicron could have been the best thing that happened; we just don’t know it yet. With hundreds of millions of new infections expected in the coming months and along with the COVID pill, 2022 might finally be the year COVID becomes endemic. As someone who tested COVID positive on Boxing Day, I hope anyone who gets infected gets as mild symptoms as I did.

Source: IHME

2. China: Every year there is always a group of people who predict an implosion in China. It’s like predicting a stock market crash every year since 2009. Despite the ongoing challenges (whether is property debt, or President Xi consolidating power), China is a hungry dragon when it comes to commodities. China’s economy is commodity inefficient (i.e consumes more commodities than they need to) and despite efficiency measures, China’s appetite for all key commodities will continue to grow. The latest China November customs data saw key imports hit 200MMT, a 16 month high.

Source: China customs

3. Power Grid: Electricity demand will hit new highs in many countries. Adhoc diesel spikes will continue if power grids get challenged for short periods around the world. We are still in an energy addition mode and not an energy transition mode. As long as the energy pie keeps getting larger, fossil fuel demand will hit new highs.

4. Subsidies in the West: From high electricity bills to rising pump prices. Unlike the 1970s, no Western government has the guts to tell its people to reduce consumption. It’s all about softening the blow via price caps, lower taxes, or outright subsidies. Oil demand will remain sticky despite higher prices. Various elections in 2022 will make this a political vote winner.

Source: NBS China

5. Year of rebounding global flights: During the holidays, we read Daniel Yergin’s book called “The New Map”. It’s a great book, highly recommend it. Some golden nuggets out of this book were on global aviation. According to the book, 80% of the world’s population has not been on a plane. It took 3 years to rebound from 9/11 and 8 years for jet demand to rebound from the Global Financial Crisis. Global Jet demand is just getting started and will hit new highs soon at either end of 2022 or 2023. International aviation might have its ups and downs for the next few months, but watch domestic flights in US/India/China hit new highs.

Source: AirNav

6. US Oil Output and DUCs: Will US shale output explode again as WTI continues to trade above $70? However, unlike the previous shale boom, its only Permian that is seeing increased rig activity, while other regions like Bakken and Eagle Ford are flatlining. Oil producers are being forced to stay lean after previous years of burning cash. Gone are the day of drill, baby, drill, when all investors want are dividends and share buybacks. In addition, the ever-declining DUC (drilling but uncompleted) Wells, the US version of “OPEC spare capacity”, which will put further pressure on US production in 2022.

Source: Baker Hughes

Source: EIA DPR

7. Brazil: 2021 saw disappointing ethanol production due to various weather and agricultural issues. Due to lower ethanol production, Brazilian gasoline and diesel demand got a boost as well. In addition, with a wider mining boom continuing to benefit Brazil, expect Brazilian oil demand to remain elevated in 2022.

Source: ANP

Source: PPAC

8. India Light Ends Demand: Indian demand disappointed in 2021 mainly due to the COVID surge. However, bulk of the oil demand destruction occurred in Diesel. Light ends demand continued to hit new highs in Gasoline and LPG. In LPG, a structural bull market is underway in India, as the country actively tries to switch the bulk of rural cooking from woodburning to LPG. Indian refineries are geared for making diesel and the growing gasoline demand is bound to increase the mismatch between supply and demand.

9. Food/Fertiliser crisis: Oil markets can no longer be analysed on its own. Gone are the days of just barrel counting. The interconnectedness from other commodity markets will continue to grow and the rest of the commodity markets are far more bullish than the oil markets. Despite the cooling off in European nat gas prices during the end of December, this crisis is far from over.

Source: UN FAO

10. Crude spec positioning: It will rebound sharply and remain high. Backwardation is here to stay. The rise of the “tourist” in energy markets as portfolio managers start increasing their energy portfolio weighting whether its due to inflation or energy making daily headlines in Europe. Anecdotal evidence of tech portfolio managers dipping in energy for the first time as they worry about interest rate rises causing havoc on tech growth stocks.

Source: ICE and CTFC

11. Inflation: This will continue to be the buzzword in 2022. However, the question remains will we see rampant high inflation in China as we have seen elsewhere. The disparity between Factory Gate inflation (PPI) and consumer inflation (CPI) continues to widen. Something has got to give and most likely Chinese consumer inflation is expected to surge if this trend continues. However official Chinese data can be very inaccurate at certain times especially if it becomes a political issue.

Source: FRED and NBS China

12. Dollar Flows: This is the major headwind for commodity prices. Peak dollar bearishness occurred in early 2021, however, interest rate rises and a general flight to quality has prompted a surge in dollar buying. If we do see a financial recession or a stock market selloff, expect further dollar strengthening which can cause major headwinds for commodities despite the underlying fundamentals.

Source: CTFC

There are a lot of other factors that we haven’t discussed: but some of them are OPEC strategy (meetings will become less important as they struggle to raise production), Libya, Iran, financial recession, Russia-Ukraine, refinery margins, etc. Something for another post later on in the year. If you liked this post, we also write a daily market report that is behind a paywall. We offer 14-day trials. All our charts come from our web platform. Message us, sign up to our newsletter, or follow us on Twitter for more information.

Happy new year and we wish everyone all the best in 2022!